Understanding Depreciation Reporting in Bookkeeping and Financial Reporting

At the point when a bookkeeper estimates benefit on the accumulation premise of bookkeeping, the person considers devaluation a cost.

In a bookkeeper's announcing frameworks, deterioration of a business' proper resources like its structures, gear, PCs, and so forth is recorded as something other than a monetary expense.

Structures, hardware, instruments, vehicles and furniture all have a restricted valuable life.

Generally, fixed resources, aside from genuine land, have a restricted lifetime of helpfulness to a business.

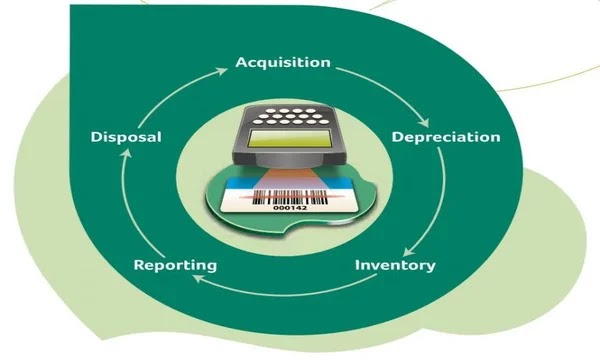

Devaluation is the technique for bookkeeping that designates the complete expense of fixed resources for every time of their utilization in assisting the business with producing income.

Part of the absolute deals income of a business incorporates recuperation of cost put resources into its reputable resources.

From a genuine perspective, a business sells a portion of its proper resources at the business costs that it charges its, clients.

For instance, when you go to a supermarket, a tiny part of the value you pay for eggs or bread goes toward the expense of the structures, the apparatus, bread broilers, and so on Each detailing period, a business recovers some portion of the expense put resources into its decent resources.

It's insufficient for the bookkeeper to add back devaluation for the year to the main concern benefit.

The progressions in different resources, just as the progressions in liabilities, likewise influence income from benefits.

The capable bookkeeper will factor in every progression that decides income from benefits.

Deterioration is just one of the numerous changes in the net gain of a business to decide income from working exercises.

Amortization of immaterial resources is one more cost that is recorded against a business' resources for the year.

It's different because it doesn't need cash in the year being accused of the cost.

That happened when the business put resources into those substantial resources.

In addition to considering depreciation as a cost when estimating profit on the accrual basis of accounting, it's important to note that depreciation also plays a role in tax reporting.

Depreciation is used to calculate the number of tax deductions a business can claim for the wear and tear of its assets.

This can have a significant impact on a company's overall tax liability.

Another important aspect to consider is that not all assets are depreciated in the same way.

The method of depreciation used can vary depending on the type of asset and the accounting method a business uses.

For example, some assets may be depreciated using the straight-line method, while others may be depreciated using the accelerated method.

Furthermore, it's important to keep in mind that when a business sells or disposes of an asset, the gain or loss on that disposal must be calculated and reported.

This can have an impact on the overall financial statements of a company.

In summary, while depreciation is a cost that is considered in the process of bookkeeping and reporting, it's only one of many factors that determine a business' income from operating activities.

The capable bookkeeper will factor in all changes in assets and liabilities to determine the net profit of a business.

Additionally, the amortization of intangible assets is another cost that is recorded against a business's assets for the year, but it doesn't need cash in the year being charged with the cost, unlike depreciation.

Another important consideration regarding depreciation reporting is the concept of "useful life".

The useful life of an asset is the period over which the asset is expected to be used by the business.

The useful life of an asset is used to determine the amount of depreciation that can be claimed each year.

For example, a building may have a useful life of 30 years, while a piece of equipment may have a useful life of 5 years.

The longer the useful life of an asset, the lower the annual depreciation expense will be.

It's also worth noting that the useful life of an asset can change over time.

For example, a piece of equipment that was originally expected to have a useful life of 5 years may end up lasting for 10 years.

In this case, the business would need to adjust the depreciation expense for that asset to reflect the longer useful life.

In addition, it's important to note that different countries and regions may have different rules and regulations regarding depreciation reporting.

For example, some countries may require businesses to use specific methods of depreciation or to follow specific guidelines when determining the useful life of an asset.

Businesses need to be aware of and comply with these rules to accurately report their depreciation expenses.

In conclusion, depreciation reporting is an important aspect of bookkeeping and financial reporting.

It involves allocating the cost of fixed assets over their useful life.

The bookkeeper must consider not only the depreciation expense but also the changes in other assets and liabilities to determine the net income of a business.

It's crucial to comply with the rules and regulations of the country and region in which the business operates.

In addition, the useful life of an asset can change over time which must be considered in the process of depreciation reporting.